Basics

|

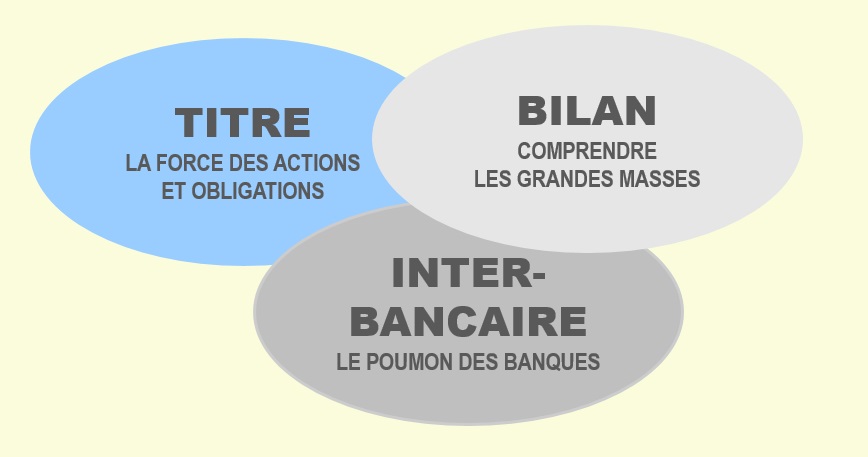

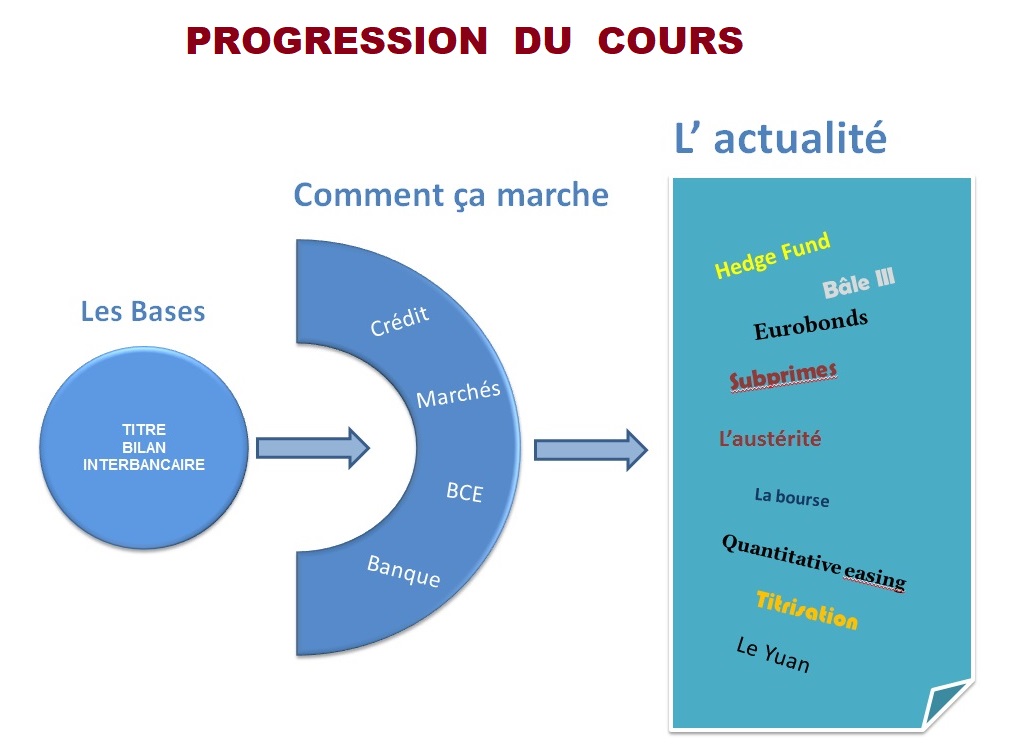

The three concepts below are independent of each other. These are the bricks to build the whole suite, from close to close, and especially WITHOUT PRIOR KNOWLEDGE! |

This is the originality and strength of the course. These carefully chosen notions are the starting point of a progressive journey in the world of banking and finance.

1- THE INTERBANK MARKET : A VITAL TOOL FOR BANKS

It seems natural to us to be able to use at any time some or all of the money that is in our account. In reality, this money is probably no longer available or only in part, because it has been loaned. Conversely, what we deposit is not necessarily lent immediately. The consequence is that at the end of the day, some banks see a surplus of deposits, others a deficit. The banks therefore invented a system of pooling surpluses and deficits to solve this problem. This system has a name,... the interbank market or money market.

Of course, customers don't realize anything,... except in the event of a crisis, where the failure of a bank can jeopardize, in turn, the entire banking system. Having this in mind completely changes the view of the banking world. The reason is simple: if a bank, which has borrowed from 10 or 20 other banks, announces the next day that it has problems, then all these healthy banks have problems. This is called systemic risk. That is why States are ready to help them, through loans and not with grants. If they did nothing, it would be panic...

2 - SECURITIES : THE MIRACLE OF THE STOCK EXCHANGE

It seems natural to us to be able to use at any time some or all of the money that is in our account. In reality, this money is probably no longer available or only in part, because it has been loaned. Conversely, what we deposit is not necessarily lent immediately. The consequence is that at the end of the day, some banks see a surplus of deposits, others a deficit. The banks therefore invented a system of pooling surpluses and deficits to solve this problem. This system has a name,... the interbank market or money market.

Of course, customers don't realize anything,... except in the event of a crisis, where the failure of a bank can jeopardize, in turn, the entire banking system. Having this in mind completely changes the view of the banking world. The reason is simple: if a bank, which has borrowed from 10 or 20 other banks, announces the next day that it has problems, then all these healthy banks have problems. This is called systemic risk. That is why States are ready to help them, through loans and not with grants. If they did nothing, it would be panic...

3 - BALANCE SHEET : A POWERFULL TOOL

It is not a question of diving into accounting, but only of seizing this often ignored tool that is the balance sheet. A tool that can be learned like a foreign language ... which would have no more than four grammar rules and twenty vocabulary words. A mini-language practiced over the water. Its usefulness is considerable. When you understand how to read a balance sheet, you immediately see how a bank, a company or a fund works. We also see those that are well (or badly) managed. And precisely, to see all this, the balance sheet is represented in the course with colored rectangles of different sizes. The "obscure table of figures" balance sheet becomes an easy-to-read dashboard. You can see the proportions right away, and that's what counts!. As with a car, you can very well interpret the dashboard without knowing exactly how it was built!

|

|

|

|

||

MAJ 06/2019