cash-flow

|

This excerpt explains the concept of cash flow, midway in the progression of online courses INFOFI2000 . It is not a subject for "beginners". These may nevertheless enter here essentially through the use made general bankers, investment bankers and fund managers. |

|

The concept of cash flow is unfortunately not very intuitive. The cash flow is not cash in the till of the company as the vocabulary might suggest. It is not profit, even if the benefit is included. Furthermore, the absence of specific international codification adds to the understanding of difficulty.

For some odd reason, the term has gained notoriety outside specialist circles. It is also he spoiled - and still strike - many students living in "business", and this for several reasons.

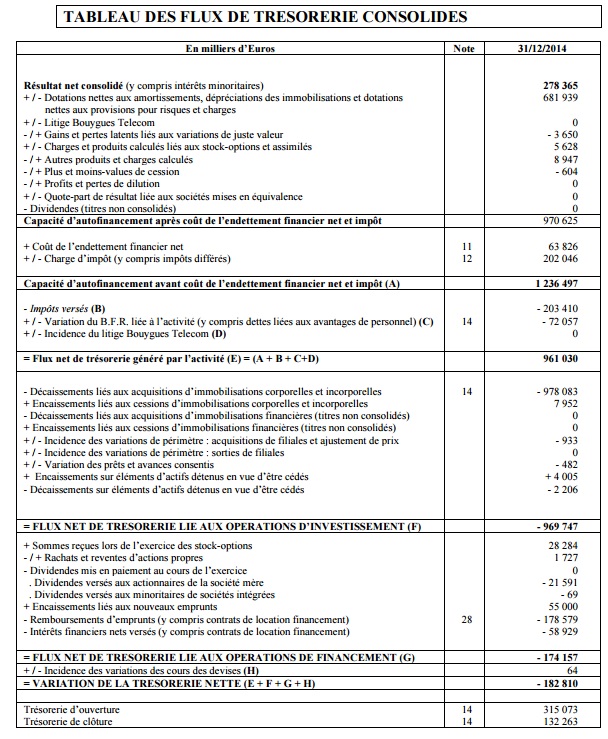

The second reason is that there are two definitions of cash flow . The other definition is cash. This is the one used in annual reports. In this context, the word refers to cash flow analysis of cash flow, presented in table form. We see how over a year, cash has evolved. With a little practice, we see how the company manages its "record low". Clearly, how it meets the need for cash activity. The banker is naturally very, very attentive.

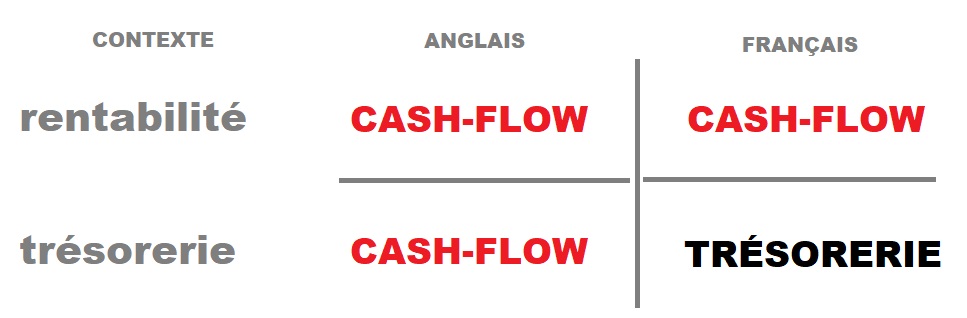

A confusion is created because in French, the word cash flow and cash password are used interchangeably to speak ... of the cash position.

The same word therefore means either a measure of profitability, and thus refers to the operating account, an analysis of liquidity, which refers to the balance sheet. But they are two different things, even if there is a link: a company that made repeated losses inevitably will have a cash flow problem. This cash is the result of commercial and non-commercial, such as cashing a credit for example.

There is actually a third definition : the cashflow word can also simply designate a flow of money without particular context. For example, a bond or credit are analyzed in financial terms as payments of suites spread over time. These payments are called cash flow, positive or negative flow. There is talk of discounted cash flows to determine the value of a company.

As often, the working definition , the more synthetic comes from English and concerns

free cash flow = "after-the-money firms generate capital investment Subtracted has-been."

This is reflected by the following formula: = free cash flow Cashflow under net income + depreciation '- real investments. To understand, we must put in mind that depreciation is a kind of notional reserve for investment. What remains of this theoretical reserves after deduction of real investment, in addition to net income to determine the free cash flow, ie the money earned by the company and actually available. All this is detailed below.

That said, why include the cash flow in a course for non-financial? Because this concept is a step toward understanding more general topics : how the banks (or rating agencies) take it to measure the creditworthiness of borrowers, how the investment banks assess the value of companies. .. how to negotiate loans with banks. Risk analysis, and generally the decision process of credit by banks are subject to a particular module INFOFI2000 course . This is the heart of banking .... therefore fundamental to the business manager, who must anticipate the banking reasoning of his "round". |

| The online course The report, meanwhile, is a more subtle and useful tool. This is a descriptive language and it is mainly a management tool ! The original pedagogy of the course is based on three basic pillars. The balance sheet is one of them ... see the basics of the course |

|

Principle and calculation of cash flow |

|

|

Concept of depreciation |

|

|

Utility banks and investors |

|

|

Gray areas WCR and cash flow, EBITDA |

|

|

Synthesis a matter of common sense |

|

| P our go further - Syllabus |

The concept of cash flow answers a simple question: what is the "real" margin created by a company? What the company really wins?

The answer to this question is not obvious. The first instinct is to refer to the net result as shown in the accounts. This accounting result has the merit to exist and to be published. This is also the reference to the calculation of tax and dividends. But it is not that simple.

The problem is that it is not a good indicator of profitability because there are elements that "disturb" its calculation. This is the case of provisions and especially the sinking , which does not represent a real cost, but can become when the company changes its hardware.

To allow to fully appreciate the performance of a company, or to compare between companies, so we use cash flow which is a restated net income, that is to say, calculated as if n ' there was no amortization expense.

As mentioned in the introduction, there are also so-called free cash flow, calculated by subtracting cash flow expenditures on maintenance of the production equipment in good condition and loan repayments. The free cash flow thus indicates the surplus really .... available to pay dividends for example. This information concerns mainly shareholders and bankers sought for new credit.

Behind all this, a certain fact: accounting is a unique tool for analyzing what happens in a company or in a bank, except on two points in particular, profitability and cash flow. It was therefore necessary to invent new concepts unfortunately likely many variations.

Here is the first definition of cash flow. This is the most common, which is for example taught to students of business schools and used by credit analysts.

|

CASH FLOW = PROFIT + AMORTIZATION |

This formula is more "talking" if we look instead of depreciation in the sequence of calculation of earnings:

As the diagram suggests, was somehow extract the amortization of the total expenditure to show only the "real" spending. If we recalculate the result with only those EXPENSES TRUE , we get the cash flow.

So there are two ways to calculate the cash flow :

| of TOP BOTTOM : CASH FLOW = SALES - "REAL" EXPENDITURES |

| to BOTTOM UP: CASH FLOW = PROFIT + AMORTIZATION |

So, add depreciation benefit is the same as not to subtract sales. In both cases it was considered that the depreciation was not an expense like any other, it is not an operating expense.

Specifically, as the Americans say: "depreciation is not a cash outflow."

Before examining why depreciation is not considered a "real" expenditure, see the second definition of the cash flow of holding also account accounting provisions .

The concept of cash flow has not been an accounting standard.

|

CASH FLOW = PROFIT + DEPRECIATION + PROVISIONS |

Both cash flow definitions can be illustrated as follows:

For simplicity, we speak only of the first cash flow in this extract. The focus is indeed the concept of depreciation.

The purpose of the cash flow is so that the book profit of the company is not really aware of its profitability. Cash flow is the result of a recalculation of the benefit.

The benefit , everyone "sees" what it is, but the damping , it is less clear. To understand we must make a foray into accounting.

Depreciation is a funny concept, it is a vague concept . Specifically, the calculation is blurred in the rigorous world of accounting. There are also other concepts of the same type (such as provisions mentioned above).

This aspect is not explained to the students. The conventional discourse and accounting practice indicate that the amortization is related to life, so to obsolescence investments. Except that no one is able to determine this life accurately.

|

To explain the origin of depreciation, a small detour. Everyone understands that the benefit is roughly the difference between revenues and costs. The benefit of the baker, for example, is what is left when removing the product of spending the bread of sales related to this activity, buying flour, pay the vendor, electricity, etc ...

But suppose one day the baker decides to change his oven. Big expense, even huge expense, likely to upset the calculation of earnings. This profit will fall sharply, perhaps turn into loss in the year of purchase, although sales of bread experiencing a nice growth. So the profit calculated in this way would make more account of economic performance.

To get closer to the "economic" reality "we" had the idea to spread the investment expenditure in time. Rather than consider in full, this expenditure is split over several successive years. And to make the calculations comparable earnings was defined durations standard by investment categories. The criterion was that of the estimated life of the related investments. "It" was the associations of accounting standards. The IRS got involved, since the spreading changes the calculation of the annual income tax. |

Cash flow reflects the profitability of the business regardless of investment spending. Cash flow is a way to measure the muscle now .

The investment and financing were of course affected the finances - is said liquidity - of the company, but not the measure of its profitability (retail close interest credit, if credit ago to finance investment) . Liquidity Changes are noticeable in the balance sheet of the company, not in the operating account .........

The cash flow is useful in assessing the profitability and value of companies.

This element derived from accounting therefore of prime interest to the bankers who lend, rating agencies and investment bankers involved in capital transactions: business sales, IPO, mergers, etc ...

The bankers who lend and the Rating Agencies , using cash flow ratios, such as cash flow ratio / turnover, but it is only one ratio among others. Risk analysis is a discipline that requires rigorous technique, of course, but also the ability of judgment. And this ability of judgment comes with experience. A bit like the doctor who needs to add a "lived" in his theoretical knowledge.

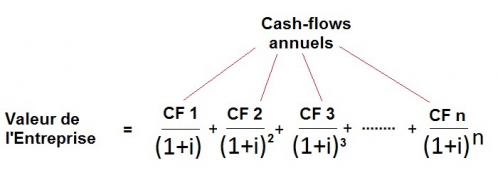

The bankers and consulting firms u tilisent the popular method called Cash Flows This publication - Discounted Cash Flows - which is one of the evaluation of the value of a business methods. This method is to simulate the account of profit and loss over a long period, say 10 or 15 years. So estimating for each year the various elements of the calculation of earnings: sales, production expenses, interest and debt ... cash flow.

then added all annual cash flows taking into account the update. Indeed, € 100 in 10 years do not have the same value as € 100 today. 100 € in 10 years worth € 100 / (1 + i) ** 10, with i equal to the discount rate, often considered the interest rate estimated over the period ((1 + i) ** 10 means ( 1 i) power 10).

The method appeals to "maths" for its simplicity. The present value of future annual cash flow provides an indication of the enterprise value. The method nevertheless presents serious limitations: it can not really predict the sales and costs of a company in ten years, and for the interest rate used for discounting i, which in reality is never constant over such a period. These same-mathematicians had the idea to weight the estimates of annual cash flow by statistical probability coefficients. The result is then in the form of several current values each assigned a probability.

If one can express doubts about the ability of the method to determine the value of a company, it is nevertheless useful for comparisons between companies. Applying the same method with the same discount rate assumptions to two companies in the same sector, one can have a good idea of their relative value.

In practice the method is used in conjunction with others. Book value is another, as the stock market value or the present value of dividends.

As always in pricing, the "real" price is one that is actually paid at some point by a buyer.

cash flow and free cash flow

The free cash flow of particular interest to bankers sought for new loans and shareholders , as it measures the money actually available to repay new loans and pay dividends. To calculate it, taking into account the expenses "necessary" to maintain the current production unit. Free cash flow is less than the cash flow. In practice, the free cash flow is calculated by the company itself, and it is mentioned in the annual report.

cash flow and trading

As has been said, the cash flow is mainly used for the calculation of ratios in the context of risk analysis or to calculate the value of a company. We are then in the area of uncertainty, estimation and especially negotiation.

Credit analysts are trying to determine the "real" risk of a company, which is obviously impossible to measure. To give this measure an appearance of objectivity, we will use the same criteria, the same ratios from one company to another. "This company has the same parameters as such other company in the same sector previously evaluated and rated Triple A. We give him the same rating Triple A". The accumulation of data over long periods allows agencies to refine the measures and reduce the margin of error, but never cancel.

One can imagine also the battles of bankers business councils in talks on a merger and acquisition transaction. Some will try to minimize the value of the company, the other to maximize this value. The calculations and re-calculations of cash flows "corrected" or not certain provisions, are one of the weapons of these negotiations.

|

The cash flow has been presented so far as a measure of profitability. As mentioned in the introduction, i l is another interpretation for the purposes of analyzing the cash.

In this reading, it is considered that the company's business gradually generates a cash flow throughout the year. This feed does not appear in the accounts as it is released into the business. One part is particularly absorbed by changes in inventories, customer credit and supplier credit (in this accounting jargon called Need for Base Bearing the WCR ). The most confusing item falls and terminology and the apparent confusion of concepts.

example of confusion of terms WCR and cash flow

Echoes appeared in the January 25, 2016

|

The financial director of the company has mobilized troops on the theme: "We have to reduce working capital." In the same circumstances, the speech of his counterpart of US group would have been: " we-have pour augmenter our CASH FLOW ".

In both cases, it is actually the same message expressed differently. The aim is to improve cash flow of the company, to produce two effects: reduce debt and thus reduce financial costs. Note that the reduction in financial expenses resulting from the increase of CASH FLOW "Cash" will cause the increase CASH FLOW "profitability" ..... |

cash flow

The calculation of the "cash flow" included in the annual reports of companies. The starting point is the cash flow of "profitability" also called cash flow (another vague term), which is added or subtracted all elements affecting liquidity.

The simplest example is the repayment of a loan . Repay a loan does not affect profitability, but liquidity. In accounting terms, only the balance sheet is affected: cash decreases, but also the debt. If, however, the company took out a new loan, it is the same phenomenon in reverse: the balance sheet increases active side (increased cash) and liabilities side (increase in debt), but no impact on the profitability .... the "detail" about an increase in financial expenses.

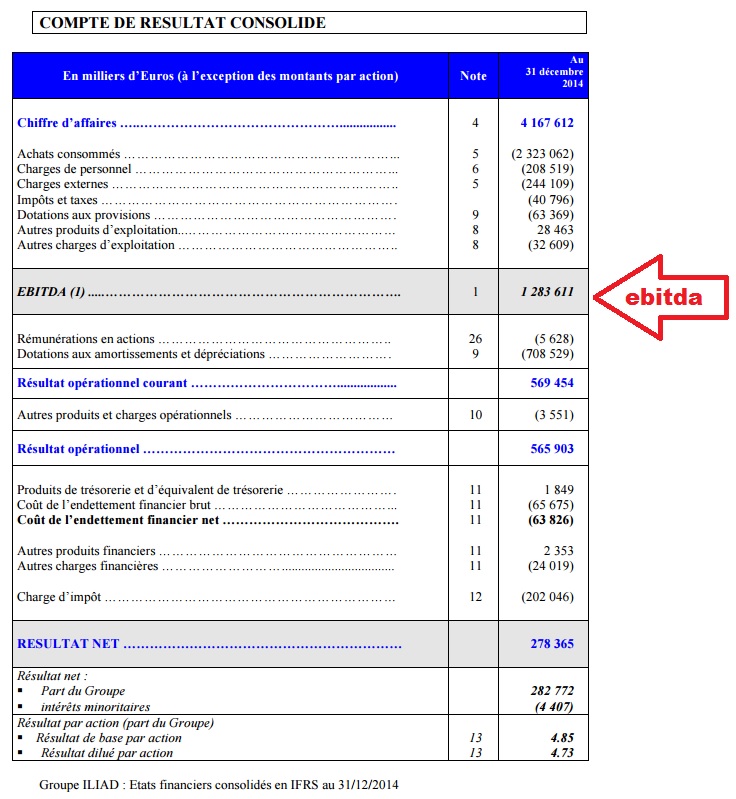

eBITDA

The EBITDA is a concept close to the cash flow that does not include interest paid . It is used to value companies before an IPO for example. However, it has computing variations from one bank to the other. ...

EBITDA means earnings before interest, taxes, depreciation and amortization, which is translated as "margin before interest, tax, depreciation and amortization".

The idea is to know what the company earned BEFORE its depreciation (such as cash flow) BEFORE paying taxes (which vary from country to country), BEFORE its provisions and financial costs ( that one and the other, are not related to the activity). L has philosophy is clear: these elements. is not related to the business of the company, it is more accurate to overcome it when it comes to profitability comparisons.

The EBITDA is calculated from cash flow, EBITDA = cash flow (plus amortization net income) + tax + interest + provisions.

It can also be calculated "from above", as does Iliad in its annual report:

The ebitda especially interested markets. In a given sector, the comparison of profitability "pure" companies to identify those that are promised to the best stock performance.

.

Note that an international harmonization could not be found on the use and meaning of the word cash flow. We must therefore get used to the co-existence of terms and concepts, each of which corresponds to a particular professional context: EBITDA, cash flow, free cash flow.

To navigate in the diversity of interpretations, it is necessary to refer to the context .

As we have seen, there are two major cash flow of families, as we consider the point of view of profitability and that of the cash . It is true that there are links between the two, since a poorly managed cash will result in high financial costs that will weigh on profitability. However, the starting point is different in either case. We must also accept that calculation shades appear within these large families.

Take the example of profitability: the "stripped" definition of cash flow is earnings plus amortization.

In this definition, it does not include provisions . If the purpose of the analysis is to measure the "true" profitability on a specific exercise, it must of course look at them closely, because behind a provision there is a probability or an anticipation of spending.

There is indeed the general provisions for general risks and provisions for a real, but vague in its amount or date of completion. Two criteria are to be considered, the actual risk of realization of the risk and its recurrence. The best example is that of a tax adjustment, related to litigation under discussion. The company is sure to be rectified, but there is great uncertainty about the adjustment amount and date.

Common sense.

In the context of assessing the value of a company, it would be absurd to provision for future unlikely risks. If there really are some risks and future, they must be considered as costs and not as provisions. It is the same for the comparison of two companies of the same sector. If the goal is to determine which of the two companies is the most profitable, it is useless to consider risks identical to the one and the other, because we reason by difference.

Similarly, it may be necessary to remove the calculations the factor "financial interests" and the factor "provisions". What then is calculated is a "big margin" does not take into account these two factors. It's ebitda, which allows comparisons of companies from the perspective of stock market investments.

To continue in this perspective "scholarship", take the example of a shareholder questioned the company's ability to pay dividends at some point. What then is the interest free cash flow . The free cash flow is what remains when the company made the necessary renewal of its equipment, and when she made the repayment of its loans. This share is actually available to shareholders. Its calculation is included in most annual reports.

There are exceptions, of course: some companies borrow to pay dividends! But we must look closely at why.

Nothing in common between Apple and EDF and Total, for example. Apple prefers to borrow rather than using its huge cash offshore because the interest is less than the tax that should be paid to the IRS for repatriation of this cash. EDF and Total did not have the means to pay dividends for the year 2015. But keep investor interest for future calls in the market share of these two companies .... unless not whether instead pay expected dividends by the State ...

This diversity of views explains the difficulty in codifying the concept of cash flow. We understand the complexity of annual reports on this point. These annual reports are intended for a wide audience: the lending banks, brokerage analysts, prospective investors, shareholders of the moment, etc .... The annual reports provide all the elements allowing everyone to bring out the aggregate which interested .

|

By browsing this excerpt, you could get an idea of the CLARITY explanations on the particular subject of cash flow. |

To go further, it would:

Assimilate the concept of balance .

Digging operation s banks and financial markets .

Understand how banks lend to businesses.

To go further, the basics course ![]() are particularly important: they are the "bricks" of the e-learning course itself. The INFOFI2000 course is the only one possible to understand at the same time the three areas banking, finance economy. And above all, without any prior knowledge !

are particularly important: they are the "bricks" of the e-learning course itself. The INFOFI2000 course is the only one possible to understand at the same time the three areas banking, finance economy. And above all, without any prior knowledge !

SEE OTHER EXTRACTS ( click on picture )

|

|

|

|

|

|

||

|

|

|

|

|

||

|

||

Update 20/09/2017